James Osborne of Bason Asset wrote a very good post on the topic of tax-loss harvesting, and how much of the “tax alpha” that is ascribed to it is likely overstated. James writes:

“I pulled a handful of client accounts that had been around for at least a few years and looked at what amount of losses were harvested. For the random accounts sampled, in 2015 I harvested between 2% and 4% of the account value, and in 2016 between 1.5% and 4%. The variance depended primarily on asset allocation and inception dates. So in each of 2015 and 2016 you could estimate that we were taking around 3% of account value in harvested losses ($3,000 on every $100,000 in the portfolio). If you want to use some of the ridiculous math supported by certain robo advisors, you can get pretty close to that translating to 1.5% in tax alpha. But I think that’s absurd.”

I am largely in agreement with James. Frequent if not frenetic tax-loss harvesting likely creates drags on returns all its own as it likely means mounting trading expenses and possible opportunity costs, depending on how it is executed.

With this in mind, I thought it would be informative to examine the real-life experiences of a client in order to see what lessons could be garnered from certain strategies I had employed in attempts to maximize tax-efficiency.

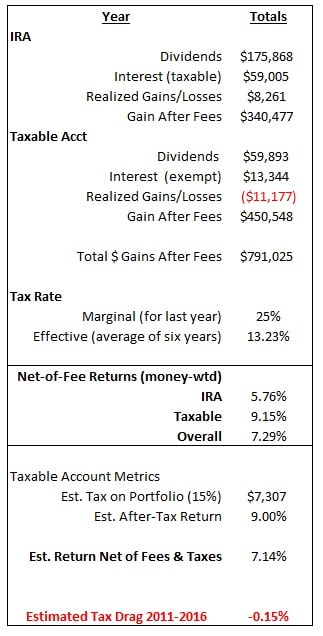

First of all, for simplicity’s sake, I examined two accounts of roughly similar size: a retirement account, and a taxable account, and I broke out the return components (dividends, interest, etc) over the years 2011-2016. Without getting too much into the details of the holdings, suffice it to say that the portfolio was structured in such a way that the IRA was composed of the majority of the client’s fixed-income holdings (corporate and government bonds, for example), as well as equity components from high-dividend sectors such as utilities and consumer staples, while the taxable account would be almost entirely equities, and even then the equity components would predominate from growth sectors (that is, less likely to pay current dividends) such as technology and biotechnology. In this way, it was hoped that the client would be able to avoid as much current taxation as possible.

Here are the results of the two accounts, and of the portfolio in aggregate [remember that qualified dividends are taxed at 15% up until the highest bracket, and for married filers, the 3.8% ACA surcharge kicks in with modified AGIs > $250,000]:

It may not seem like much, but the fact that the client was able to keep almost 100% of his net-of-fees gain is actually fairly significant. Had the investment compositions of the two accounts been reversed, the tax drag would have been substantially higher at an estimated -.75%.

While these distinctions may not seem all that meaningful, they actually are, especially as they accrue over time. In contrast, the “tax drag” of many active equity mutual funds can approach four-fifths of a percentage point (if not more) annually, while for taxable bond funds the tax drag can be substantially more.

It is worth noting that while most equities are owned in tax-deferred accounts, some 60% of household financial assets are exposed to current taxation, as Philosophical Economics has noted. In light of this, it seems worthwhile to see the tax drag on two very common asset-allocation strategies, the 60/40 domestic and global portfolios:

Because of the 40% allocation to bonds, which are taxed at ordinary income rates, the tax drag on these funds is significant over time, eating up a good portion of the gross returns. It is therefore difficult to overstate the benefits of a tax-efficient allocation.

However, the benefits do not end with reducing current taxation on your portfolio. There are further benefits from a long-term planning perspective as well. Under current tax law, beneficiaries of holdings in a taxable account receive a stepped-up cost basis, meaning that their cost basis is the value of the holdings on the day of death for the decedent. In the example of my client, the unrealized gains on the taxable account are in the hundreds of thousands of dollars, meaning that whenever the holdings pass on to the beneficiaries (assuming no major market crash between now and then, of course), they would in effect receive a substantial tax-free transfer of wealth.*

With the IRA, however, the beneficiaries will have various options for how they want to handle distributions from the account, but they will be taxed at their ordinary income rate. In light of this, it seems to me that from a long-term, multi-generational perspective, allocating growth to taxable accounts is the prudent thing to do, all else being equal.

It should be noted, however, that for those who have substantial IRA assets, and who may or may not need a lot of current income from the account, it may make sense to employ a more aggressive distribution strategy to mitigate the impact of forced distributions after age 70.5. Conventional wisdom usually recommends deferring taxation as long as possible, but for those with large pension incomes or other sources of income that push up their tax brackets, continued deferral of retirement accounts along with forced distributions at higher and higher account values will almost certainly mean considerably more taxes owed.

For those in a situation similar to this, it may make sense to take advantage of years when effective tax rates are lower, perhaps due to the retirement a spouse (and thus a reduction in household income), or what have you. This is especially important in a progressive tax structure. As a recent CFA publication noted, opportunities to make IRA withdrawals at low effective tax rates should not be missed. This type of strategy has a compound effect because not only does it remove the issue of income tax from future considerations, it also set up the proceeds to be reinvested with the potential for a tax-free inheritance as described above. One additional benefit to allocating the fixed-income component of a portfolio to a deferred account is that can make returns more predictable, and future values perhaps easier to forecast, thereby making advanced tax planning that much simpler.

*This is assuming the estate tax is not an issue, of course.

I am not a tax adviser, and I do not give tax advice. You should consult with your tax professional before acting on any of the information included in this post.

Disclosure: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Fortune Financial Advisors, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Fortune Financial Advisors, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.