Tax-Deferred Retirement Account Distributions

In general, distributions you take from tax-deferred retirement accounts are taxed as ordinary income when they are distributed. If that retirement account included stocks that appreciated in value while you owned them, you will pay ordinary income taxes on the stocks’ value when taken as a distribution, the resulting tax bill can be significant.

If some, or all of the stock is in the company you worked for, there is an opportunity to reduce that tax burden.

The NUA Treatment

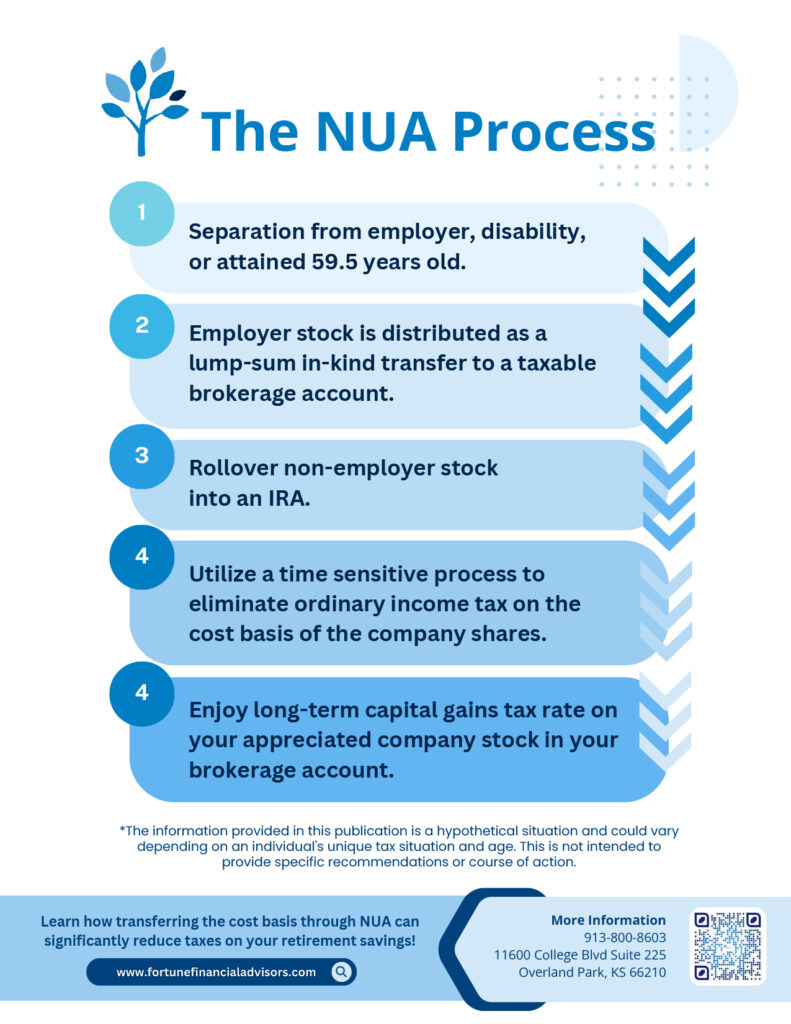

Employees who invest in company stock inside the plan may later be able to take advantage of the Net Unrealized Appreciation rules which can be used to lower the tax rate applied to withdrawals from the plan. Through Net Unrealized Appreciation or NUA, the IRS will only tax the basis – the purchase cost – of company stock at ordinary income rates. Any appreciation in that stock gets taxed at the lower capital gains rate. If you have been fortunate to have worked for a company whose stock has appreciated significantly in value during your tenure, utilizing the NUA strategy can save you a great deal of money.

For example, a 401(k) that you have holds company stock with a current value of $300,000, but it only cost $50,000 to acquire through the plan. Distributing it normally in retirement would result in you paying ordinary income tax on the full $300,000. By applying one NUA strategy, you would only pay ordinary income tax on $50,000, and the much friendlier long-term capital gains tax rate on the remaining $250,000. A second NUA strategy could result in paying as little as zero dollars in ordinary income taxes, with the full $300,000 based on long-term capital gains rates.

The NUA strategy can save you money in another way as well. When an employee leaves an employer, a typical strategy is to roll the assets from the company retirement plan into a qualified plan at a new employer, or to an Individual Retirement Account (IRA). This allows for the funds to continue to grow on a tax-deferred basis. Pulling NUA qualified stocks out of the retirement account before rolling that account into an IRA, means that there is less money in the IRA. Since minimum required distributions (RMDs) are calculated based on a retirement account’s value, having less money in the IRA reduces your RMDs and lowers the tax bill on those RMDs as well.

NUA treatment is a powerful tool for the right situation. However, there are a number of factors you need to keep in mind when considering the NUA treatment for your company stock.

Triggering Events

In order to apply NUA treatment to a stock, there must first be a triggering event, such as quitting, getting fired from your job or retiring. Death, disability and turning age 59½ also qualify as triggering events.

Tax-Deferred Accounts Only

After a triggering event, certain rules need to be followed to ensure that the stock is eligible for NUA. The stock must be in a tax-deferred retirement account. Accounts like Roth IRAs and other tax-exempt vehicles don’t qualify. If the stock is held within a mutual fund, the fund must only hold the one company stock or cash. Stock from other companies disqualifies the fund. You can still diversify your 401(k) and invest in other funds within it while working.

Choosing The Right Strategy

There are a lot of nuances in dealing with retirement account distributions. Choosing the right distribution strategy as part of your financial planning can have a significant impact on your income during retirement.

Due to current tax laws, a $1.0 million 401(k) or IRA portfolio will likely not produce $1.0 million in retirement income. For most middle-income taxpayers, you will net approximately 25% less due to combined federal and state taxes. So, right off the bat, fully ¼ of your retirement assets will not be available to support your lifestyle during your post-career years.

Fortune Financial has the expertise and experience to ensure that distributions are handled properly, so company stocks don’t lose NUA eligibility through missteps. We incorporate tax planning strategies into your financial plan to minimize the tax bite, and most importantly, potentially provide more income during your retirement years.