In “Relative Equity Valuations, Diversification, and Creative Destruction,” I argued that one of the main attributes of the U.S. equity market, – one that warrants it a premium to other global markets, – is its dynamism, which almost ensures that the leadership of the market, whether by sector, industry, or company, is constantly changing. The practical effect of this is that investors in U.S. equities, unlike most of their foreign counterparts, are not relying on the same handful of companies that have dominated other markets for years, if not generations. An additional result of this innate market dynamism is that the ability of only a few giant companies to dominate the market is checked by the creative destruction that serves as a kind of automatic rebalancing mechanism for the market.

To follow up on that theme, I wanted to share a few data points that illustrate that even though the feeling is that the U.S. market (as gauged by the S&P 500 index) is currently dominated by several megacaps such as Apple, Alphabet, and others, the reality is that the current market weightings are fairly average, and perhaps even less top-heavy than it has been in the recent past.

First of all, as one can tell from the table below, the current weighting of the top ten S&P 500 components is a little more than 20%, with Apple holding the top spot at 3.73%:

This seems fairly concentrated at the top until it is revealed that from 1980 through 2014 (the latest for which I have data), the average weighting of the top ten S&P 500 components was about 20.5%. The current structure is nothing remarkable:

Regarding the S&P 500’s heavy concentration in Apple, this, too, is nothing remarkable. From 1980 through 2014, the average weighting of the S&P 500’s top position was about 3.8%:

To demonstrate further just how average the current market weighting actually is, one can examine the spread in terms of market weighting between the top component and the tenth-ranked component. Currently, the spread between Apple and General Electric, the current tenth-weighted component, is about 2.57%. From 1980 – 2014, the average spread has been about 2.4%:

Even though the top portion of the market is remarkably average in terms of size and weighting, there is a legitimate argument to make that growing sectors such as technology are crowding out smaller sectors such as materials and utilities, leaving the market much less balanced on a sector basis than it has been historically. Furthermore, technology companies currently make up about 11% of the top ten of the S&P 500, which is only below 1999 in terms of weighting, when the technology sector made up more than 29% of the S&P 500.

Investors, – particularly those of the passive variety who structure their global portfolios purely based on market capitalization, – would be prudent to consider these factors when structuring their portfolios. Many emerging market portfolios benchmark against the MSCI Emerging Market Index, and as a result, they are likely to have high information technology exposure, given that information technology now composes one-fourth of the MSCI EM Index, which is a larger IT weighting than even that within the S&P 500.

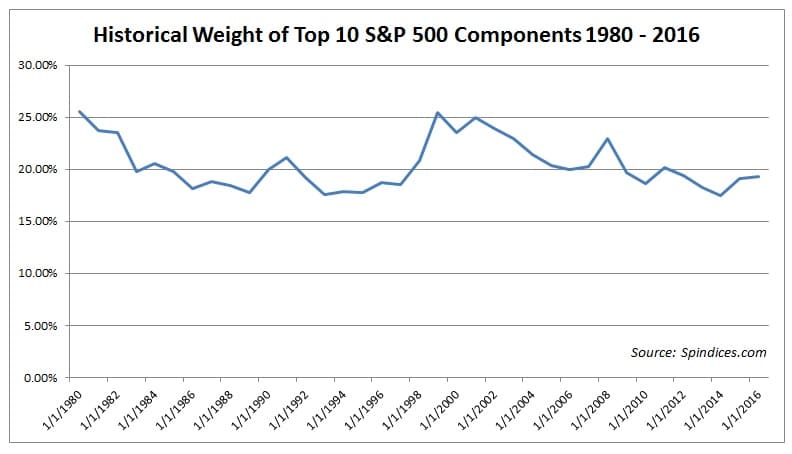

UPDATE: Here are the updated charts through 2016:

Historical Weight of Top 10 S&P 500 Components 1980-2016 (average weight of top 10 through 2016 is 20.4%):

Historical Weight of Top S&P 500 Component 1980-2016 (average weight of top component through 2016 is 3.74%):

Historical Spread Between Top S&P 500 Component & Tenth-Weighted Component 1980-2016 (average spread through 2016 is 2.39%):

Lastly, here’s a look at the historical number of companies needed to total to 50% of the S&P 500 Index value:

Both employees and clients of Fortune Financial Advisors, LLC may have positions in some or all of the stocks mentioned in this article.

Disclosure: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Fortune Financial Advisors, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Fortune Financial Advisors, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.