By most measures, 2015 was a very difficult year for asset allocations. You can see from the table below that just about every asset category other than large cap US stocks and treasurys suffered a down year (all data from Morningstar):

However, the performances of the market-cap weighted S&P 500 and the price-weighted Dow Jones Industrial Average do not do justice to exactly what happened in the equity markets. Guggenheim’s equal-weight version of the S&P 500, symbol RSP, posted a total return of -2.66%. To give another example of the market’s bifurcation, Eddy Elfenbein, author of the Crossing Wall Street blog, pointed out recently that as of January 6th, almost 40% of the S&P 500’s component stocks were down >20% from their 52 week highs.

Charles Schwab’s Liz Ann Sonders had a great post on just how difficult a year it was, unless your had concentrated positions in a handful of names like Amazon and Facebook. Here are some of the key points she makes:

Obviously, it is very unusual ‘expensive’ stocks to outperform their cheaper counterparts (at least longer-term), and dividend paying stocks tend to outperform over the long-term. However, 2015 was an anomaly by these two measurements.

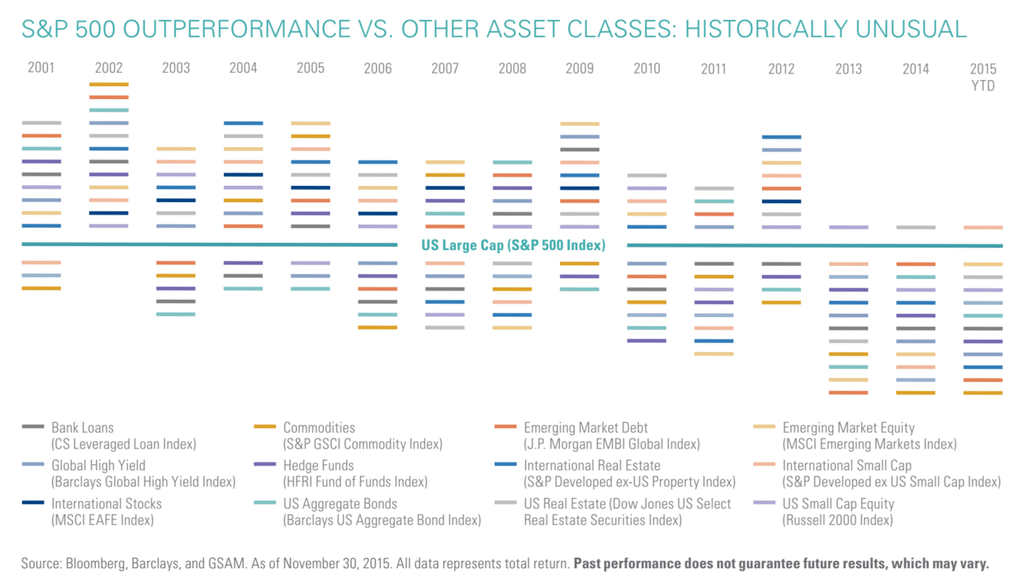

Furthermore, Goldman Sachs has an interesting infographic on just how anomalous the S&P 500’s dominance performance-wise has been (since 2001):

Well, as you are probably aware, 2016 has not gotten off to a great start. January 1st was one of the worst opening sessions in quite some time, and the selling has continued into the rest of the week. However, there are a few reasons why this should not bother you.

First of all, to refer back to Liz Ann Sonders and her work mentioned earlier, the market has tended to do well after flat years, which could probably be considered years of consolidation:

Secondly, as JP Morgan demonstrates, valuations, – while not extremely cheap, – are not excessive, and are more or less in line with 25 year averages:

Finally, if you are worried that the lousy start to 2016 dooms the markets for the rest of the year, you probably shouldn’t be. As Birinyi Associates mentioned today, extrapolating the full year’s performance based on the price action of the year’s first week is foolish:

Happy New Year!