Last week, I discussed how the key factors of diversification and dynamism explain, if not justify, the premium valuation that US equities enjoy over most other global equity markets that are characterized by far more concentration and stagnation within their components. I think, however, that there is quite a bit more to be said on the topic, and that is the focus of this post, which will attempt to contextualize relative equity valuations by analogizing the stock market to the credit markets, an idea similar to that offered recently by Philososophical Economics.

First of all, let us begin with a minor tangent on the word credit. While in financial terms it is often associated with specifics about the debt markets, the word itself is derived from the Latin credere, which means “to believe.” Basically, when we say someone “has credit,” it means that he is believable. It is no different in a financial sense; when someone has good credit, it means that he is more likely than not to pay back a loan, or be a good steward of the capital entrusted him. I think historian Forrest McDonald put it best when he defined credit as “the willingness of others to put money in your hands.”

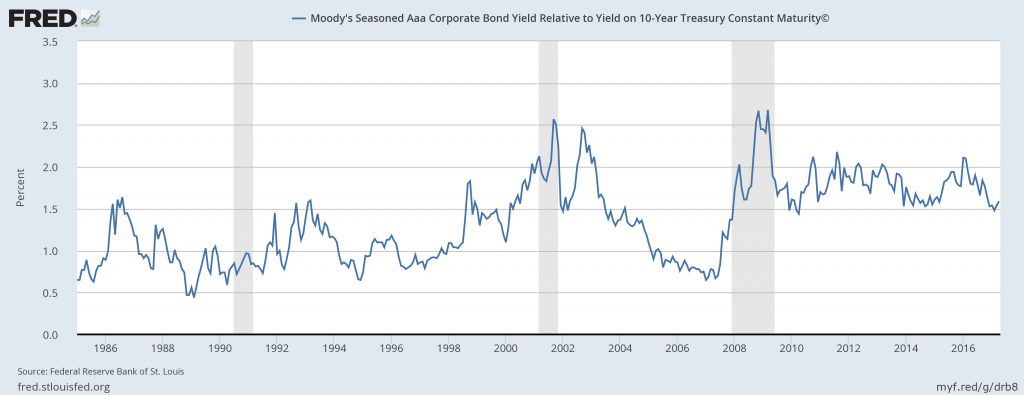

In the debt markets, the entity with more “credit” is, naturally, going to be charged less interest on a loan than one with less credit (read, “higher risk”). A simple illustration of this concept is the spread between the highest-rated corporate debt, those rated Aaa by Moody’s, and the treasury notes issued by the US government:

[to enlarge image, right click & “open image in new tab[

Obviously, the market has charged a higher rate of interest to these quality corporations than it has to the US government. Another way of looking at this is that investors were willing to pay a premium, – that is, they were willing to receive less interest in return, – to loan money to the government because they had more confidence, on a relative basis, in receiving back their principal, and not least because they would be more able to sell the bond before maturity if necessary, as the US treasury market is the largest and most liquid in the world.

This credit analysis is really no different from the analysis that investors perform every day in the equity markets. That this is so can be seen by taking three large energy companies the products of which are basically fungible, meaning that there is not much of a discernible difference between the end product as there is between an Apple iPhone and a Samsung Galaxy, for instance:

All of these companies have suffered in the halving of the oil price since the summer of 2014, yet Chevron trades at a substantial premium to France’s Total, and a huge premium to Brazil’s Petrobras. By inverting the forward price-to-earnings ratio into a forward earnings yield, the similarities to the credit market more readily reveal themselves. Investors are willing to “lend” their capital to the U.S. energy company while demanding less in return than they are from Total, and far less than from Petrobras.

Why is this the case?

Interestingly, since August of 2000 (the earliest for which common data are available), Petrobras actually outperformed both Chevron and Total, 10.22% annualized, versus 9.55% and 6.24%, respectively. Yet the ride was far more volatile, with far deeper downdrafts along the way:

Setting aside the argument that Petrobras, as a state-owned enterprise, warrants a discounted valuation, a compelling case can be made that its discount can be explained in the way a high-yield bond’s higher yield relative to a treasury bond can be: in the very long run, the return might be higher, but along the way there will be much greater periods of volatility which lessen an investor’s chance of actually realizing that higher return. Combine that with the fear that a newer company from a newer market with far less history can survive a nasty downturn, and suddenly the discount to France’s Total and the U.S.’s Chevron seems reasonable. In other words, Petrobras has a far shorter “credit history,” and the history it does have is extremely volatile. It is no wonder, then, that investors will pay less, – really, demand more yield in return, – to lend their capital to the firm.

This argument can be made with the major global equity markets as well. A developed market such as the United States with a long history not just of healthy returns, but also of surviving the downturns, should trade at a premium to a newer, “less creditworthy” global market. Such a history breeds confidence with investors because the returns, while no easier to predict, are felt with more confidence to be realized, at least over a long enough time frame.

A further example of how this should matter to relative valuations can be seen in a 2012 study by the CFA Institute which found that future equity returns for a developed market such as the U.S. can be explained with a much higher degree of confidence using Shiller P/E analysis. The researchers found that because of a much smaller data sample for emerging market equities, – and also, the authors conjecture, because emerging market equities are not as integrated into the global equity marketplace, – far less of subsequent emerging market equity returns can be explained by Shiller P/E than is true of developed market equity returns:

(via CFA Institute)

As an investor, this should matter to you because you are told that emerging market equities are cheap, but you know that 1) the data sample telling you that is small, and 2) common valuation metrics such as Shiller P/E has shown to be far less useful in emerging market equity analysis, meaning that the relative cheapness may not matter anyway. It should follow, then, that just as you would more likely accept far less in interest income by loaning your money to a less risky but more predictable borrower that you would also pay more (again, that is “receive less”) to own developed market equities than for cheaper (that is, “higher interest yielding”), but far more opaque (in terms of future returns) emerging market equities.

Similarly, we sometimes look at zero-yielding Japanese or German bonds and scratch our heads, but buyers of those, it goes without saying, are more concerned with receiving back their principal than with earning a return on it. If history shows that high valuations such as those today have offered flat returns over the subsequent few years, then that is really not all that much different from investors not being willing to allocate capital to cheaper emerging markets for fear of loss of principal, even though the higher yields available offer the promise of greater rewards.

A final useful credit analogy is the duration one. A bond with a shorter maturity is going to have less duration (that is, in a broad sense, sensitivity to interest rate changes) than a bond with a longer maturity. Simply put, investors will charge less in interest to get their money back sooner. The idea is really no different in the equity markets. In previous posts, I have talked about how U.S. corporations, in addition to being the best-run and most efficient in the world, are also leaders in terms of returning cash to shareholders (chart via Credit Suisse):

[to enlarge image, right click & “open image in new tab]

Whether through buybacks, dividends, or a combination of the two, U.S. corporations return more cash more frequently to shareholders, which of course should lessen the duration of U.S. equities relative to equities of less generous markets, and should bolster their relative valuations accordingly, ceteris paribus.

All of this, of course, is not to say that US equities are not overvalued, or that emerging market equities are terrible investments. Rather, the idea is to help investors use basic ideas from credit markets – which, by the way, seem far easier to grasp than equity markets, – so that they can better understand why things are valued as they are. Too often investors think in binary terms, such as “cheap” or “expensive,” and do not look past the basic valuation metrics to determine why something is priced as it is, and to determine if it is really a capital-worthy investment or not. Hopefully this post helps in some way to aid investors in their decision-making and capital-allocation decisions by looking at equity valuations in a different light.

Disclosure: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Clients of Fortune Financial Advisors, LLC are long Total and Chevron.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Fortune Financial Advisors, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Fortune Financial Advisors, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.