The market’s vicious sell-off has investors reacquainted with nervousness for the first time in a long time, and there has been no shortage of explanations for the return of volatility. Some have breathlessly called this sell-off the start of a new bear market, never mind the fact that bear markets outside of recession are extremely rare, as CNBC’s Michael Santoli points out this morning.

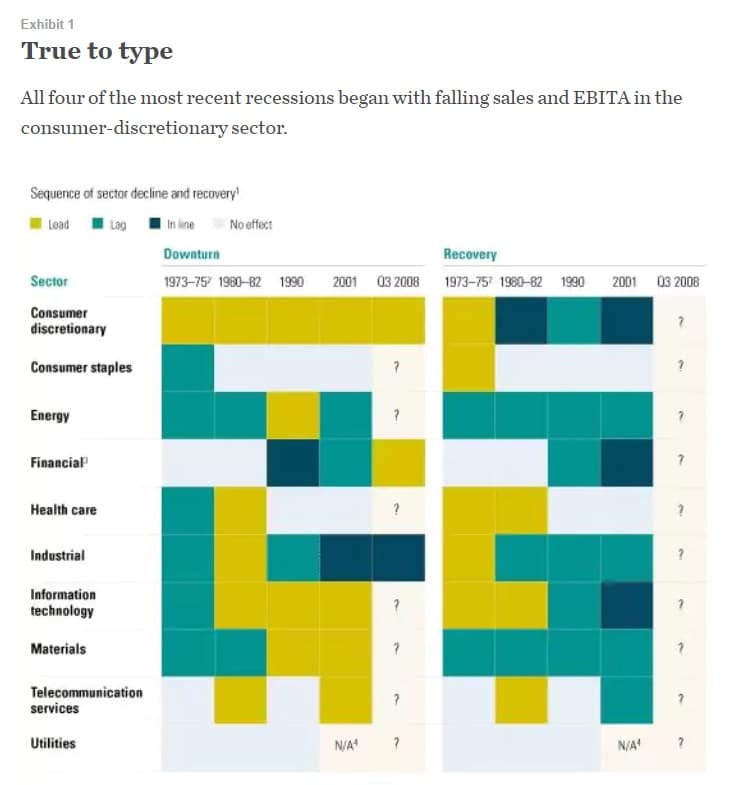

That being said, while there is little evidence suggesting an economic slowdown, let alone a recession, the possibility should not be dismissed. With that in mind, it is worth looking at the numbers for the consumer discretionary sector, declines in the revenues and earnings of which, McKinsey & Company tells us, have presaged each of the last few recessions (via McKinsey):

The importance of the consumer discretionary sector as an economic bellwether should be intuitive, given that consumer spending accounts for roughly two-thirds of GDP. So what are the numbers for the sector telling us now?

Regarding revenues, FactSet posted today (2/12) that fourth-quarter 2017 revenue growth for consumer discretionary companies has come in at 5.6%, hardly a sign of a shrinking consumer (via FactSet):

Lest one think that the sector’s overall numbers have been distorted by Amazon, which constitutes roughly one-fifth of the consumer discretionary sector, FactSet notes that as of 2/12, 72% of consumer discretionary companies have beaten their profit expectations for the fourth-quarter (via FactSet):

What is more, these robust numbers have been reflected in the performance of the stock prices of consumer discretionary companies. Again, while many will be tempted to explain away the overall performance of the sector by claiming a distortion from Amazon’s performance, the reality is that an equal-weighted consumer discretionary portfolio (as measured by Guggenheim’s ETF, symbol RCD), has performed very well over the last 12-, 6-, and 3-month periods. While the equal-weighted portfolio has trailed both the market and the Amazon-centric XLY over the last year, it has virtually matched XLY over the last three months, while both RCD and XLY have trounced the broader S&P 500 over the period. This seems somewhat significant, given consumer discretionary’s market-leading status, and that this most recent period, of course, includes the bout of volatility that has everyone spooked (Note: price returns only):

This performance stands in marked contrast to 2007, the year the last recession began, when RCD and XLY rose with the market before ultimately breaking down well before the market peaked in October of that year:

Of course, the market may remain volatile for an extended period, and the economy may slow at some point soon. However, given the strong performance thus far in the consumer discretionary space (among other things), the odds seem to be against a recession any time soon, and thus a bit more life for the bull market.