One of the things about finance that has often baffled me is how it is that so many are very familiar with the basics of investing, but very few seem truly to understand the wider implications of financial decisions. I think part of this has to do with how people view their own prospects as well as how they view various financial choices. They may know instinctively that it’s better to save more and spend less, but they probably don’t grasp the full opportunity cost of their decisions when they misbehave financially.

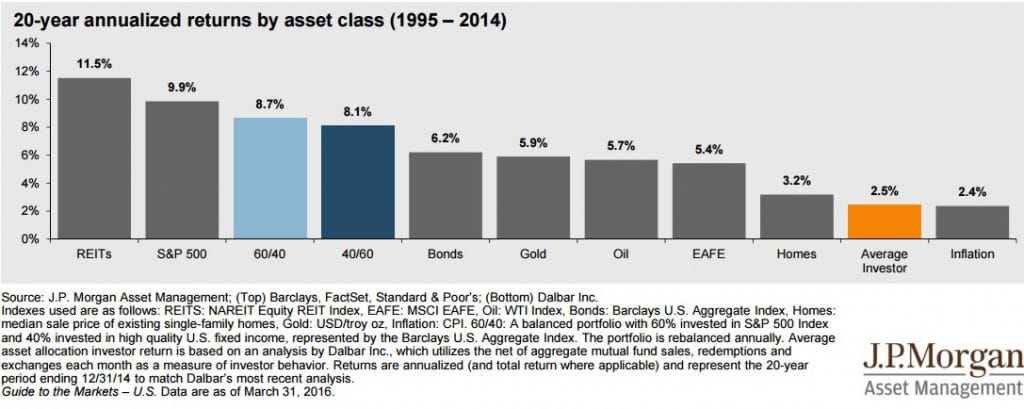

For example, many of my young clients have asked me about the wisdom of delaying their retirement account contributions in order to pay for a bigger house than they need, under the assumption that their new house will appreciate considerably over time to offset the missed investment gains. Most are surprised when I tell them that the idea of housing appreciating substantially is largely a myth. As a “real” asset, it generally keeps pace with inflation over the long run:

There may be other reasons to postpone making contributions to your portfolio. Some who are new to the work force perhaps have student debt to service or may want to start families. This describes the children of many of my clients, and these mid-20 somethings are somewhat blissfully ignorant of the exacting discipline building a nestegg requires. Many have even told me they want to defer their savings for retirement for a few years so they can travel and enjoy themselves while they are young.

So it comes as a shock to many when I explain that missing out on a significant period of compounding (say, ten years or so) can cause a huge detriment to your long-term financial goals. Consider two friends of the same age who start their careers at roughly the same time, but who take different approaches to their financial goal of retiring in 40 years at their age 65. Mike is a diligent saver, and plans to contribute the current IRA max of $5,500 to his portfolio, and to increase that amount each year by the inflation adjustment of 2%. John is a bit more like the proverbial grasshopper than the ant, and so he plans to enjoy his late 20s and early 30s by traveling and having fun. He knows he will have to play catch-up over the last 30 years of his working career just to accumulate the same nestegg as his friend, Mike. What he probably doesn’t know is that he will have to contribute almost 30% more to his portfolio (with the same inflation increase) over 30 years than Mike has to over 40 years just to have a similar portfolio balance at retirement, assuming the same rate of return of 5%:

Obviously, saving so much in a relatively short period of time can be a difficult task given the various expenses of middle age and so forth, so John’s plan to turbocharge his savings later in life is precarious at best.

On the opposite end of the spectrum are retirees or those close to retirement. Oftentimes, a person on the cusp of retirement might want to liquidate an investment account to pay off his or her mortgage at 3.5%, simply for the peace of mind of having no payment. While the desire not to have debt is understandable, the cost in taxes from the liquidation combined with the years of compounding lost on that amount easily dwarfs the total interest paid over the life of that mortgage, assuming even conservative rates of return. Yet perhaps eight of ten retirees with whom I have consulted over the years have listed this option as their first step post-retirement.

I think some of these behavioral disparities can be explained in this way: many know the basics of finance and investing, but few truly understand the implications of the basic principle of opportunity cost. General financial education tends to condition us to look at financial decisions in somewhat of a vacuum where choices are binary and are limited only to those presented in a nice, clean problem. There is a mention of the long-term, but to many, the long-term is unfathomable. Without imagining the impact in 40 years of a decision we make today, it is extremely difficult not to make poor financial choices.

That being said, I think perhaps the most consequential conversation on this topic for me was one I had with a friend of my father’s almost 20 years ago. This gentleman and I discussed my interest in finance, though at the time I had only a meager understanding of financial concepts. As the conversation drew to a close, my father’s friend informed me that he drove a $400,000 car. The man didn’t appear all that wealthy, so I was surprised at his statement, having immediately assumed he must have a Ferrari or Maybach in his garage. Probably sensing the direction of my imagination, the man interrupted my thoughts, and told me that his car was just an ordinary Lexus with a sticker price of $50,000. However, to him, the true cost was at least $400,000.

I asked how this could be, and he went on to explain that he, as a retired individual, had desired not to have any debt or payments during his retirement, so he had liquidated $50,000 of Cisco Systems, Inc. in order to pay for the Lexus. Since this transaction, the man went on to say, Cisco’s stock had split a couple times, and had appreciated significantly. Simply put, in order not to pay interest of perhaps $5,000 or $6,000 over the life of a 5 year car loan, the man had cost himself some $350,000 in taxes and opportunity costs. Setting aside the possibility that this man had sold his Cisco stock precisely at its peak level, the point remains the same: by cannibalizing a portion of his nestegg in order to avoid debt to purchase a depreciating asset, he had reduced his capital pool, and therefore limited his future options.