Those of us who are market buffs like to sit around and contemplate how much wealth one would have if only we had gotten into a lottery ticket stock at the entry-level price. For example, I looked at Oracle (ORCL) stock the other day. Using my Morningstar hypothetical database, I was able to calculate that if I had been able to buy the stock at its IPO price in March, 1986, I would now have about $6.96 million. A tidy little 24.31% return.

But there’s an alternative to that outcome as well; what if your broker had recommended Oracle as a can’t miss stock circa March 2000? The outcome would have been less than tremendous: average annual returns of 1.31% through March of this year.

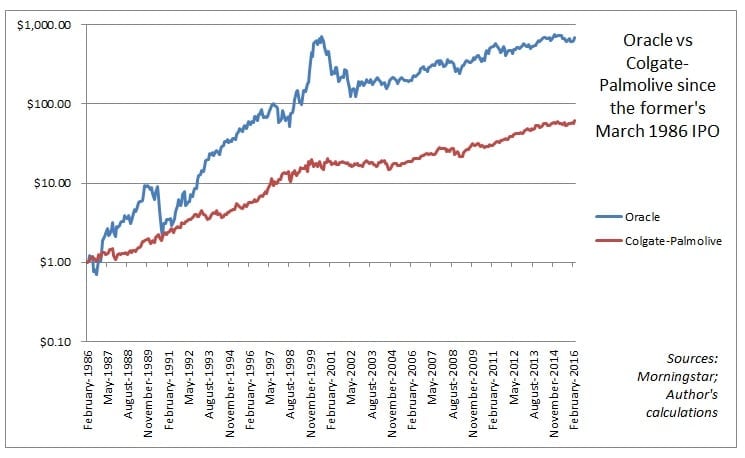

Comparing the chart of Oracle since its IPO with that of a consumer staples company like Colgate-Palmolive is telling:

Obviously, over the same timeframe, Oracle’s performance dwarved Colgate-Palmolive’s. But it did so with a much greater probability of disappointing results for prospective investors; over the timeframe shown, the worst 3-year period for Oracle investors was -34.74%; for Colgate-Palmolive investors, it was -6.85%.

The problem with “lottery” stocks is that a lot of their gains come in small periods of time; it’s doubtful whether the majority of shareholders realize anything close to the gains they might see on a retrospective “what-if” chart. A large reason for this uneven performance over long periods of time, I believe, is that investors tend to overpay for innovation, but they discount stability. We like to think about returns in an absolute sense when what really matters is the consistency of returns.

Here are a few more examples of “lottery” stocks versus their “boring” counterparts:

Going back to a common start date of June 28, 1972, an investor who started with $10,000 in Intel (INTC) would have gained an average of 19%/year and ended up with ~$17.6 million. Another investor in Altria’s (MO) would have ended up with “only” ~$10.6 million, earning 17% along the way. However, the returns were unevenly achieved:

Microsoft (MSFT) vs McCormick (MKC) yields similar results, but with an even more glaring contrast between the consistency of returns between the two companies over the 5-year periods shown:

Finally, just one more example to hammer home my point, Cisco (CSCO) vs Procter & Gamble (PG):

Obviously, valuation matters. You can take issue with my choice of comparisons, and you can argue that now some former lottery stocks are now cheaper than their consumer staple counterparts. But my point remains the same: when evaluating a potential investment, start first with your goal. If you are shooting for the highest absolute return, recognize that you will suffer long periods in the investing desert, and you must have the fortitude to maintain those positions for the very long run. However, if your goal is not to bat for the fences but rather to obtain steady and consistent returns which matter very much to your every day life (say, for instance, if you are living off your portfolio), then the criteria you use to evaluate a particular investment should match up with that.

Both employees and clients of Fortune Financial may at any time have positions in the companies mentioned in this post. This post is not a recommendation to buy or sell any securities. It is for educational purposes only.