The word simple is sometimes used as a pejorative; to say that someone is “simple” is to suggest that he is less intelligent than others, or, perhaps, that he is naive. This view is, however, wrongheaded, and in few instances in life is this truer than in finance. As I have noted before, the greatest idea in the world is useless if it cannot be communicated well, and that is why when presenting financial concepts and ideas to clients, the simplest approach usually yields the greatest results.

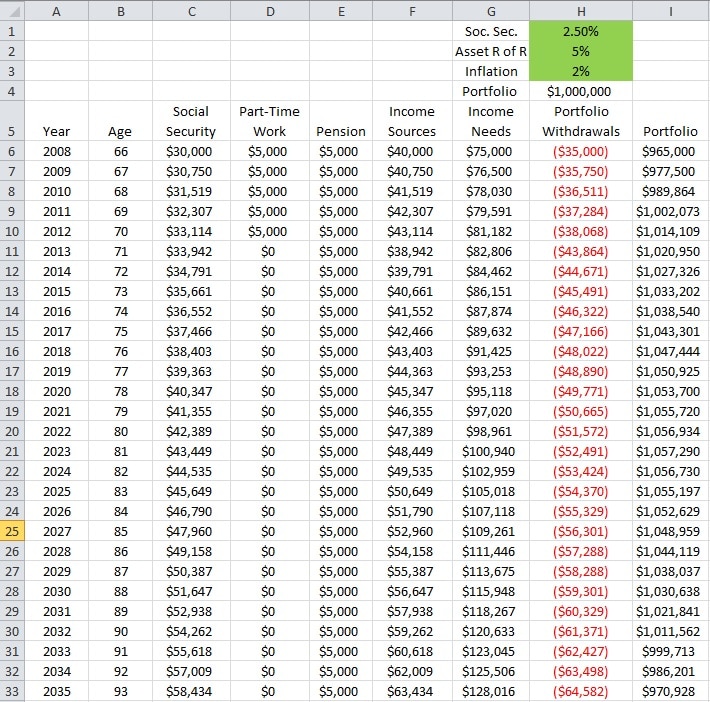

Never was this more apparent to me than in 2008-2009, when many of my current clients, now retirees, were forced into retirement as a result of the recession, and quite a few were extremely apprehensive about having to live off of the income generated by their retirement portfolios. This was understandable because it is a difficult transition for people who have been disciplined savers for 40+ years to be forced, quite unprepared, into having to live off the disbursements from their savings. In these cases, while a thick binder of graphs and projections might have been the usual industry approach, I discovered that something as no-frills as a basic spreadsheet calculation had the most impact:

The great thing about a spreadsheet is that anyone with basic computer skills can interact with it, and the fact that the basic assumptions — inflation, average returns, etc — are highlighted and dynamic mean that the advisor and client can run countless projections with a few key strokes. There is also the benefit that the client can take the file home to interact with it if he so chooses; he is not a captive audience of the advisor and his proprietary software. This is empowering to the client and doubtless goes a long way toward the client not feeling like the only agenda of the advisor is to sell him financial products he does not need.

Another lesson I learned is that people tend to respond more to dollar figures than percentage figures, and this seems to be particularly relevant in retirement planning. For example, when these nervous new retirees were having difficulty grasping how their nestegg would be transformed into a series of cash flows, the most effective means of demonstrating this was not a series of complex graphics, but rather a simple report that showed the actual distributions (by portfolio holdings) projected over the next twelve months. Saying that a simple $1 million 60/40 portfolio of ETFs (SPY/EFA/VWO/VBR/IEF) would generate 2% in dividends and interest each year is not as powerful as showing portfolio income of ~$23,000, which is what the client needs to pay his bills:

(Note: (taken from a fictional Morningstar report. Right-click image and select Open image in new tab for larger view)

Another simple and effective practice for advisors to use when interviewing prospects is to take the meeting as an opportunity to present to the prospect your regulatory profile. In the financial services industry, trust is paramount, so it is safe to assume that you, the advisor, who will be charged with handling an individual’s life savings, will be viewed in a somewhat skeptical light until you have earned the trust of the prospect. Therefore, it is useful to broach this topic to the prospect right away, taking him directly to your publicly available FINRA BrokerCheck record to highlight your clean history, or to explain anything that would warrant it. Being forthcoming about these things sends a powerful message that you operate transparently, and that you are comfortable with your record of client service.

Of course, there will be clients who will demand complexity, perhaps because they feel like there is a correlation between the thickness of a financial plan and its predictive accuracy, or that there is a connection between the indecipherability of a portfolio report and the portfolio’s value. In most cases, however, clients who are not financially sophisticated will respond positively to concepts and ideas that they can grasp readily, and that means presenting them in the simplest terms possible.

Disclosure: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Fortune Financial Advisors, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Fortune Financial Advisors, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.