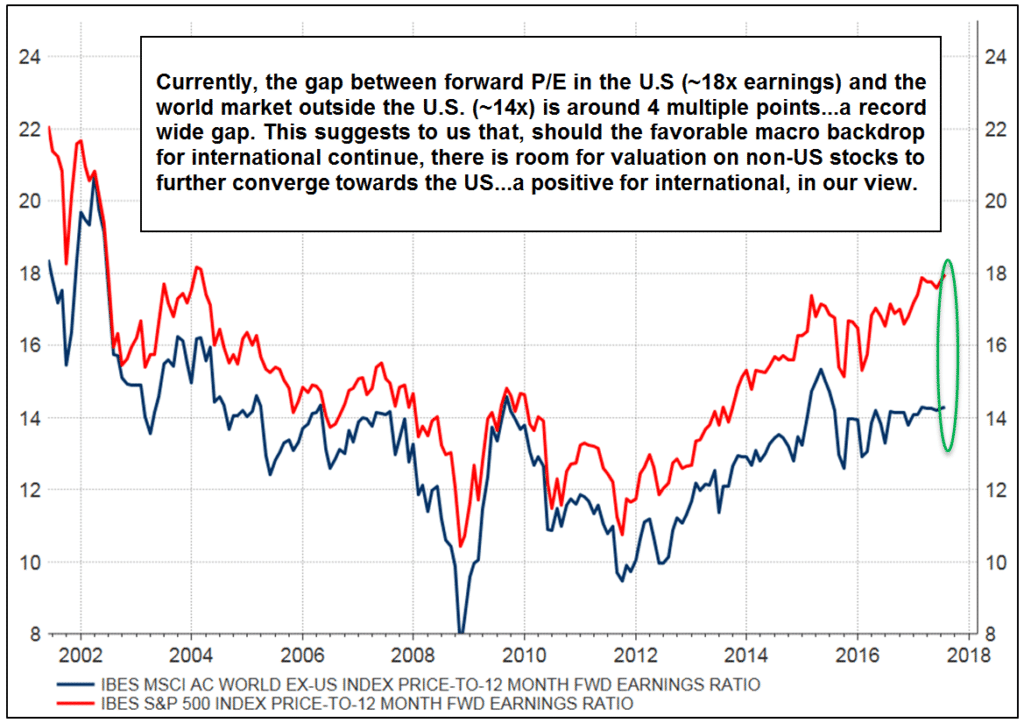

Chris Konstantinos writing over at ETFTrends.com shares a very interesting chart, which shows a wide gap in the forward price-to-earnings multiple between the S&P 500 and MSCI World ex-USA index:

At first glance, such a disparity in valuation seems compelling, and it would appear to make sense to underweight U.S. equities relative to the rest of the world, as some have argued. However, I would caution investors to think twice before doing so, as making allocation decisions based solely on aggregated valuations is misguided.

It is a common, – but false, – belief that global equity markets are somewhat interchangeable, and all an investor has to do to earn superior returns is to shift capital to whatever may be cheapest. Yet this is not the case as very few individual equity markets are sufficiently diverse to make a comparison worthwhile, and even when a comparison is warranted (e.g., Europe vs U.S.), deeper analysis reveals that much of valuation disparities can be explained by differences in sector or industry composition.

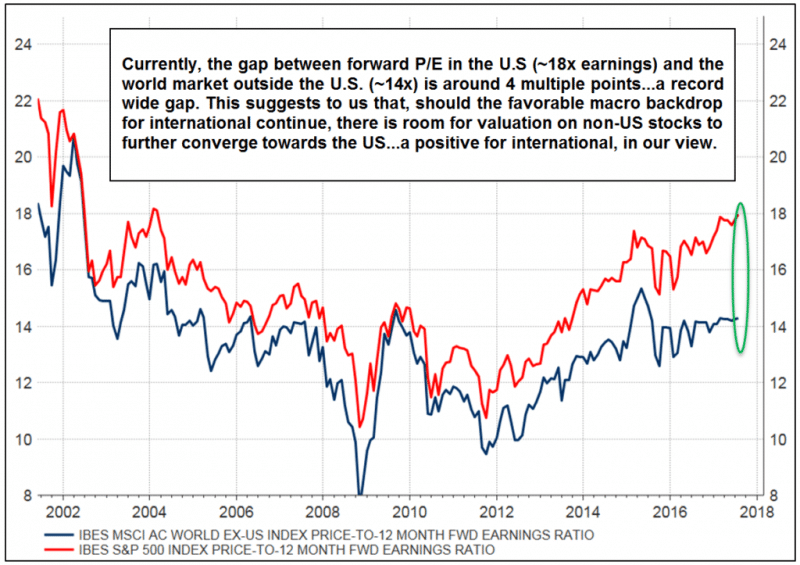

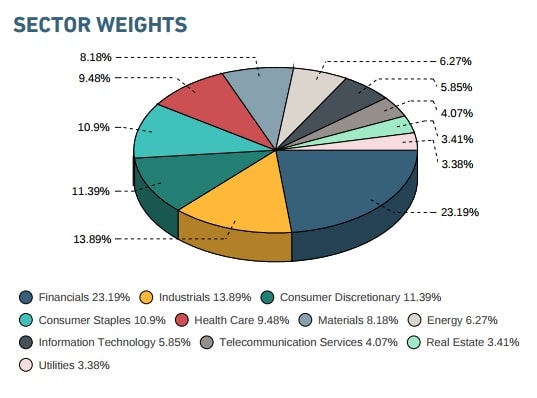

For example, here are the sector compositions for the MSCI USA index (roughly equivalent to the S&P 500)…

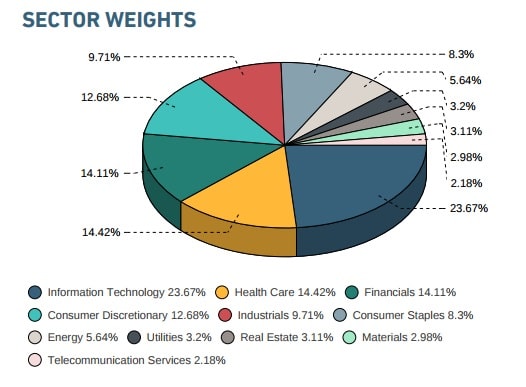

and the MSCI World ex-USA index:

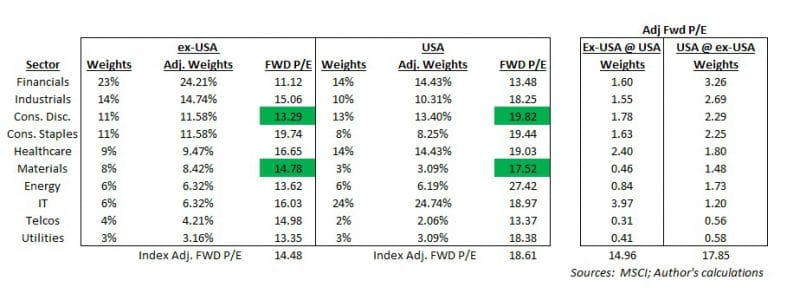

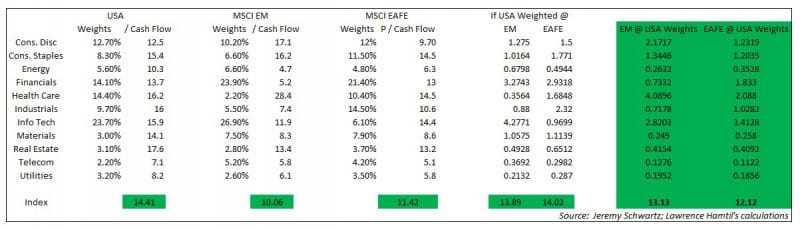

The U.S. market is obviously very heavy in tech and health-care stocks, which historically have traded at premium valuations, while the rest of the developed world is heavy in financial and industrial stocks, which tend to trade at discounted valuations. To see just how much sector composition distorts aggregated valuations, simply interchange the valuation and composition data (as of 8/31/17):

[Note: I subtracted real estate from both indices, and re-weighted each index.]

In other words, if the U.S. index were weighted the same as the ex-U.S. index, its multiple would drop from 18.56 to 17.88, while adjusting the ex-USA index would raise its multiple from 14.47 to 14.98. In sum, the gap narrows from than four points to just under three points. That may not seem like a significant difference, but the analysis should not stop there.

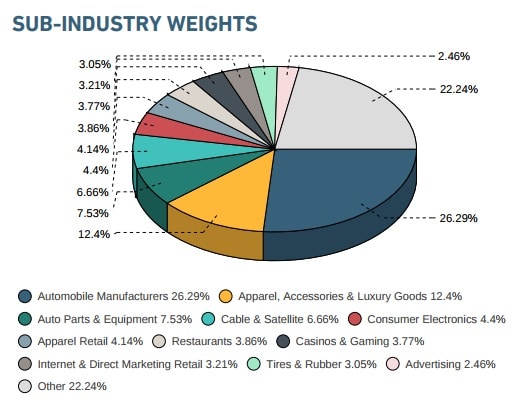

Two of the biggest valuation differentials between sectors are in the materials and consumer discretionary space. Again, these disparities are easily explained with further analysis. Consider that more than one-third of the MSCI ex-USA Consumer Discretionary index is composed of automobile-related industries…

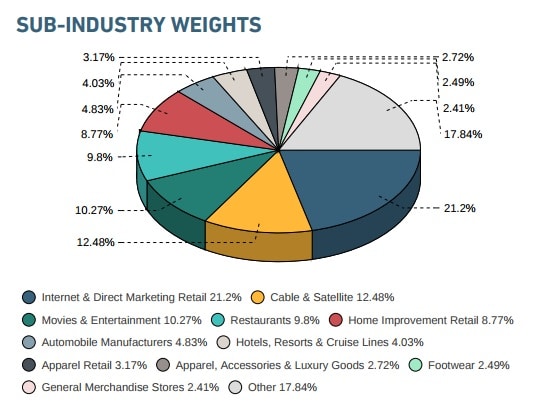

…while the MSCI USA Consumer Discretionary index is more than one-fifth internet retail, with Amazon.com alone representing ~14%:

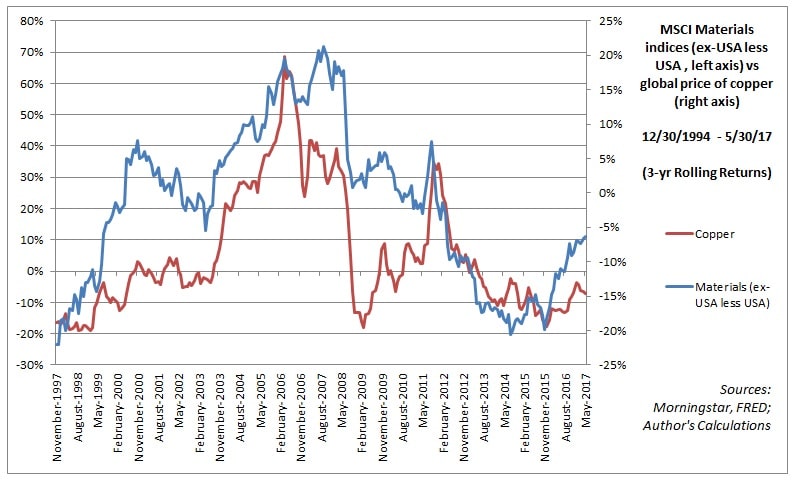

In the materials space, the ex-USA sector is heavily tilted to metals and mining, while the comparable U.S. materials index is heavy with things like industrial chemicals. If you do not think this matters, simply look at the difference in performance between the two indices versus the price of copper. The two series are more than 75% correlated over the last 20-plus years:

It should be surprising to no one that the traditionally boom-and-bust metals and mining industry would command a lower multiple than the comparatively stable industrial chemicals industry.

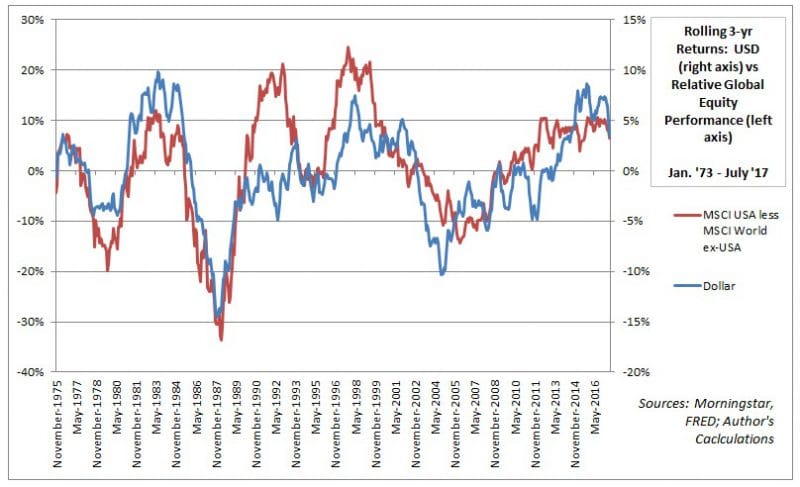

Furthermore, favorable valuations may not matter if the dollar regains strength. Since 1973, excess U.S. performance has been 70% correlated with dollar strength:

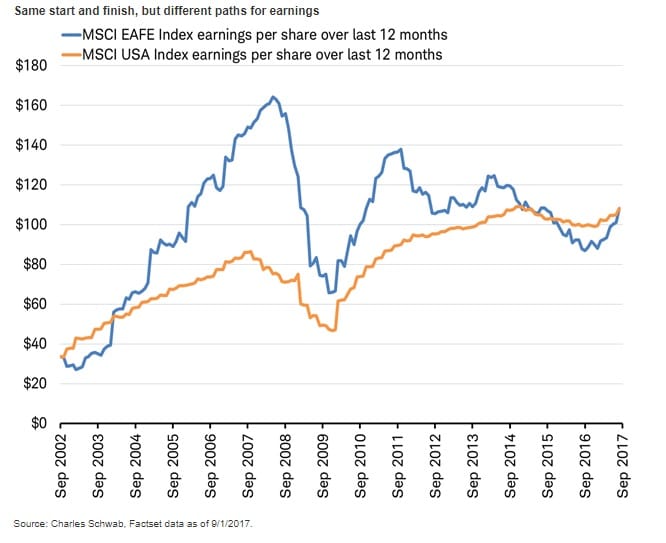

So, yes, U.S. stocks are expensive, but the rest of the world looking cheap by comparison does not automatically make it a bargain. I am all in favor of owning foreign equities, but I do not think major shifts in allocation should be made based solely on aggregated valuations. Instead of saying things like, “The U.S. is expensive, and the rest of the world is cheap,” investors would be better-served to frame the decision like this: “The U.S. is expensive, but does it really make sense to underweight Apple and Amazon relative to HSBC and BHP Billiton?” Furthermore, when considering prospective returns based on valuation differentials from the last twenty years, ask yourself what seems more likely to occur: mean reversion in the U.S. to averages last seen more than twenty years ago, or a resurgence of foreign banks and miners to peak earnings that were the result of simultaneous and massive financial and commodities bubbles?

[Chart from Jeffrey Kleintop of Charles Schwab.]

Note: For cited graphics, links to the sources can be found in embedded in the text.

Appendix – Sector adjustments for MSCI USA, EAFE, & EM indices, re-weighted to compare price / cash flow as of 8/31/17:

Both the author and clients of Fortune Financial own shares of Apple and Amazon.

Disclosure: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Fortune Financial Advisors, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Fortune Financial Advisors, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.